Are you struggling with regular federal student loan payments? Some people find their monthly payments higher than their income and aim to switch to a different repayment plan.

If you can’t afford your monthly payments, it may be a wise decision to qualify for public service loan forgiveness.

In this article, we are going to talk about four income-driven repayment plans offered by the federal government to help you choose the best option.

Basics of Income-Driven Repayment Plan

You may select one of the four income-driven repayments (IDR) plans from the federal government to help you lower your monthly payments. This repayment plan is based on your income and family size.

It may be less than 150% of the poverty threshold or even $0 for unemployed consumers. It is free of charge to submit your application for this plan.

The Loan Simulator online can be useful to estimate monthly bills under different repayment plans.

This way, you will know how much you will have to pay each month and define which option is more reasonable for you.

When should you switch to one of these plans? Here are the main instances that may be the reasons for choosing an income-driven repayment plan:

- You will qualify for Public Service Loan Forgiveness

- You can’t afford your present bills and aim to avoid student loan default

- You have high student loan debt while being unemployed or with low income.

What Income-Driven Repayment Plans Are Available?

We all want to find guaranteed loan approval no credit check when we face a financial emergency. It may be wise to look for additional monetary assistance to cover your short-term cash gaps but when it comes to student loan payoff, it’s better to switch your repayment plan to avoid loan default and late payments.

You may select among four different IDR plans:

- Income-Based Repayment (IBR) Plan. The maximum monthly payment under the Income-Based Repayment plan is 15% of discretionary income (10% for new borrowers). This payment will never be more than the sum you would pay under the 10-year Standard Repayment Plan. The repayment period is 25 years or 20 years for new borrowers.

- Pay As You Earn Repayment Plan (PAYE). The maximum monthly payment under the PAYE plan is 10% of discretionary income. This payment will never be more than the sum you would pay under the 10-year Standard Repayment Plan. The repayment period is 20 years.

- Income-Contingent Repayment Plan (ICR). The maximum monthly payment under this plan is 20% of discretionary income monthly payment on a 12-years fixed plan, adjusted based on your income. The repayment period is 25 years.

- Revised Pay As You Earn (REPAYE) Plan. The maximum monthly payment under this plan is 10% of discretionary income. The repayment period is 20 years provided that all loans being repaid on the plan were obtained for undergraduate study. The repayment period is 25 years if any loans being repaid under this plan were obtained for graduate or professional study.

Who Is Eligible for Income-Driven Repayment Plan?

The majority of student loans are eligible for at least one income-driven repayment plan. You may go through particular eligibility demands for each plan to check which option works best for you.

Pay attention to the lending option you have as it may affect your eligibility for every IDR plan. Sometimes, it is necessary to consolidate your student loans first to qualify for a specific plan.

Besides, if you have defaulted on loans you won’t be eligible for any IDR plan. The Loan Simulator is beneficial to check how your loan repayment would alter under various IDR plans.

Also, it will help you estimate:

- Your repayment period

- Your monthly payment account

- Prospective loans forgiveness

- Total interest you will need to pay

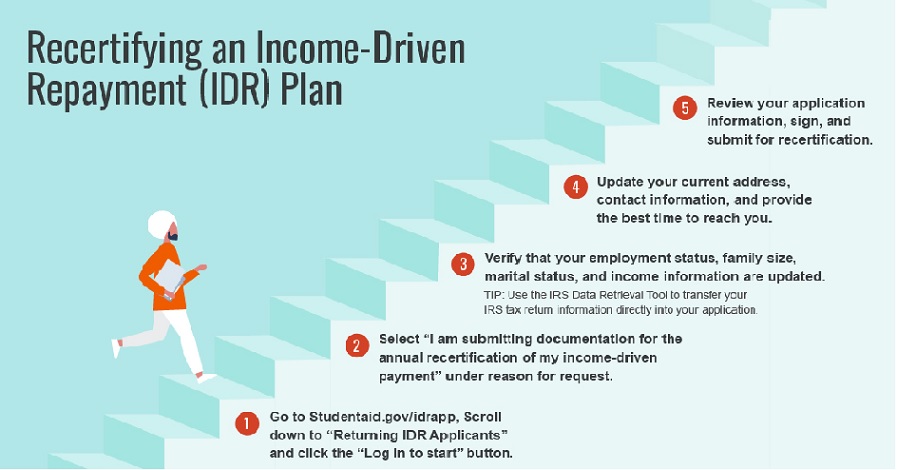

How to Apply for IDR Plan

The Federal Student Aid platform describes how an income-driven repayment (IDR) plan can save you money as the monthly payment is based on the applicant’s family size and income.

Additionally, payments a borrower makes on an IDR plan may count toward Public Service Loan Forgiveness (PSLF) provided that he or she meets other demands for PSLF.

You may apply for this repayment plan by sending your student loan services a paper request form or at studentloans.gov.

The information about your most recent federal income tax return and your family size will be needed to complete the application.

Those who didn’t file taxes will have to submit alternate proof of any taxable income they have earned within the past 90 days, including:

- A letter from a recruiter listing the gross pay

- A pay stub

- A signed statement describing their income in case formal documentation isn’t available.

Drawbacks of Income-Driven Repayment Plan

As you can see, choosing an IDR plan can be beneficial for you. It offers plenty of advantages to consumers who can’t afford regular student loan payments. However, it’s important to keep these factors in mind:

- Any changes to your family size or income may increase or reduce your monthly payment.

- You may pay more in interest over time. When you have lower payments over a longer payment period, more interest will accumulate.

- You can be demanded to pay income tax on any forgiven sum if you still have a balance at the end of the repayment period.

What If Your Family Size or Income Changes

It is significant to recertify income-based repayment each year to keep your IDR status. In case your family size or income changes, your monthly payments will also change.

When a consumer misses their recertification deadline, they will need to pay more until they re-enroll.

This larger sum will most likely be the standard repayment plan sum. The interest will be added to the principal balance or capitalized. Keep in mind that IDR recertification dates were extended until March 2023.

Also Read:

2. Defending BMX Olympic Gold Medalist Connor Fields Is …

3. There’s Someone Inside Your House Review Problematic Secrets …

The Bottom Line

Many American consumers struggle with their student loan payments.

If you are one of them and can’t afford to make on-time federal student loan payments, you have a chance to qualify for public service loan forgiveness and select one of the four income-driven repayment plans.

Each of these plans is suitable for certain people and may lower your bills. The sum will depend on your income and family size.

You may contact your student loan servicer to get more information about managing your loans and making loan repayment less stressful.